The IEA’s latest edition of the World Energy Investment report gives an update on energy investments for 2023 and a first look at 2024 trends. The findings reveal that we are significantly off track to meet our energy goals and more incisive efforts are needed to meet COP28 goals. This includes accelerating in moving away from fossil fuels, tripling renewable energy capacity, and doubling energy efficiency improvements by 2030.

This article will delve into these key findings, exploring the current state of energy investments and the pathways necessary to achieve a sustainable energy future.

Clean Energy Investment Hits New Heights

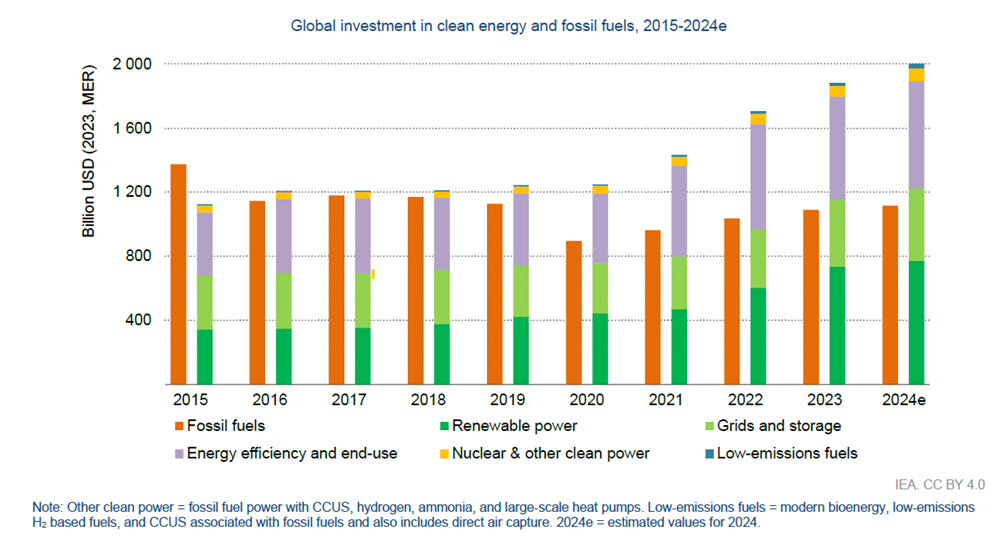

In 2024, global energy investment is expected to surpass USD 3 trillion for the first time, with USD 2 trillion of that amount allocated to clean energy technologies and infrastructure. This marks a significant shift as investments in renewable power, grids, and storage now exceed total spending on traditional fossil fuels.

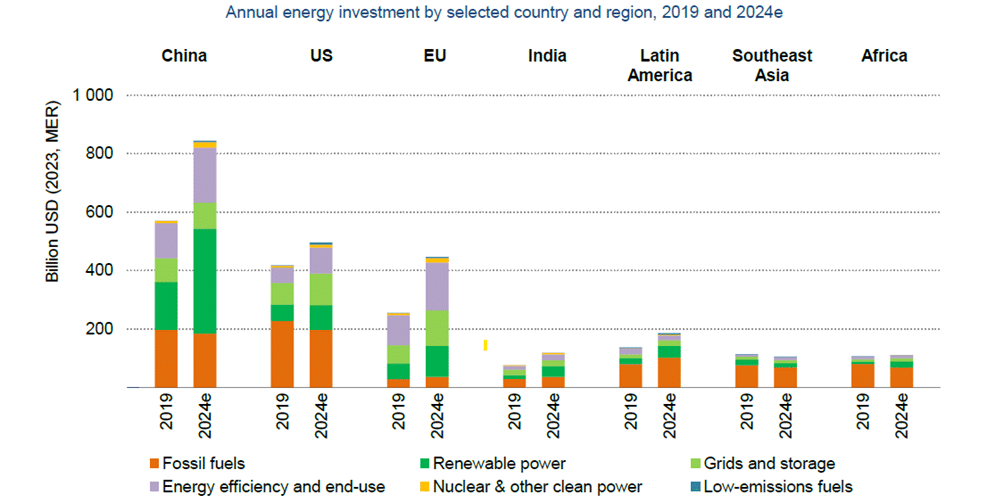

Nonetheless the World Energy Investment report continues to warn of imbalances, particularly in emerging and developing economies (EMDE) outside of China, where clean energy funding remains inadequate. There are some positive signs of growth, in countries like India, Brazil, parts of Southeast Asia, and Africa, where new policy initiatives, well-structured public tenders, and improvements in grid infrastructure are starting to drive investment. For example, Africa’s clean energy investment in 2024 is projected to reach over USD 40 billion, nearly double the amount seen in 2020. However, there is still the need of something more since many least-developed economies are left behind in the clean energy transition.

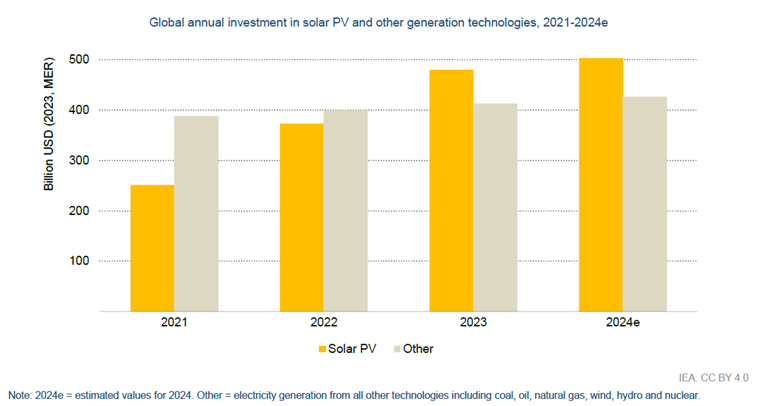

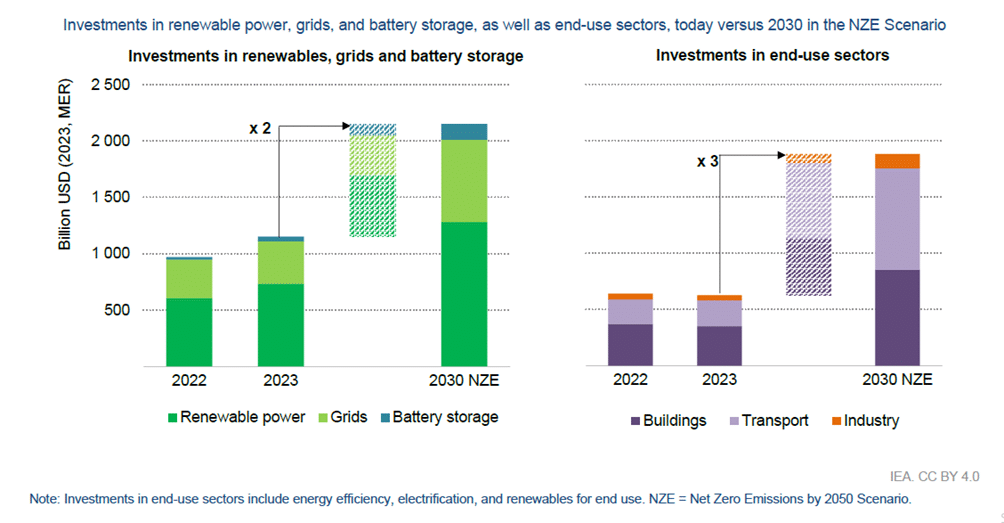

The global trend shows a sharp shift towards clean energy. In 2015, the ratio of clean energy to unabated fossil fuel investment was 2:1, while in 2024, that ratio is expected to reach 10:1. As illustrated in the graph, investment in solar PV now exceeds that of all other generation technologies combined. In some countries the expansion of solar and wind energy has driven down wholesale electricity prices. However, this underscores the need for additional investments in energy storage and grid flexibility to ensure stability in the market. Grid investments are finally on the rise and are expected to reach USD 400 billion in 2024 after stagnating at USD 300 billion annually since 2015.

Spending on battery storage is growing rapidly, projected to exceed USD 50 billion in 2024. However, this investment is highly concentrated in advanced economies and China.

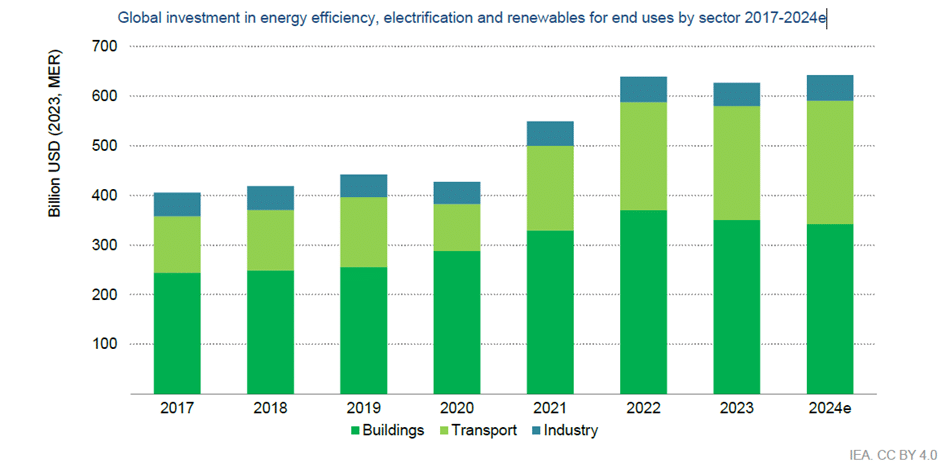

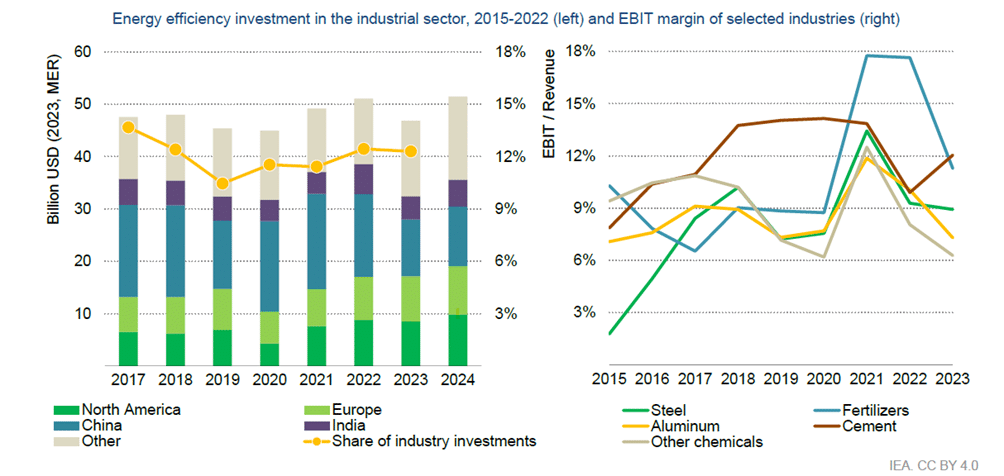

Investment in energy efficiency and electrification has remained stable but this result has been achieved thanks to the dynamism in the transport sector while investment in energy efficiency in building and industry have dropped respectively by 5% and 8% in 2023 over the previous year.

Despite the growing interest in low-emission fuels, investment in fuel supply remains heavily focused on fossil fuels (570 billion USD expected in 2024), with low-emission alternatives starting from a modest base but expanding rapidly. A major influx of investment in LNG is anticipated over the next few years, driven by the construction of new liquefaction facilities, mainly in the United States and Qatar.

In terms of national investment trends, clean energy investment in the United States is expected to exceed USD 300 billion in 2024, a 1.6-fold increase from 2020 levels, significantly outpacing fossil fuel investments. The European Union is currently spending around USD 370 billion on clean energy, while China is projected to lead with nearly USD 680 billion, driven by rapid growth in solar, battery, and electric vehicle manufacturing.

| Focus box: challenges in end-use investments in energy efficiency and electrification The slowdown in investment in the end-use sector coincides with a challenging macroeconomic environment that has affected the affordability of both energy efficiency technologies and financing. Inflation has driven up the cost of energy and technologies, while high interest rates have made obtaining financing more difficult and expensive. Moreover, these elevated interest rates have constrained governments’ fiscal space, limiting their ability to provide incentives for energy efficiency.  Looking ahead to 2024, we anticipate that aggregate spending in end-use sectors will remain relatively unchanged compared to the previous year, reflecting the ongoing challenges posed by high inflation and interest rates. Taking a closer look at the industry sector investment in energy efficiency and electrification contracted in 2023, erasing the gains achieved in the preceding two years. This decline was primarily driven by a decrease in investment in China. When compared to global capital expenditures across all industrial sectors, energy efficiency and other end-use investments have stagnated, representing 13% of total investment in 2023 compared to 14% in 2017. This suggests that even during periods of high energy costs, such as 2021-2022, energy efficiency and end-use investments have not been prioritized.  The upcoming years are critical for aligning the energy system with the NZE Scenario. Recent reductions in government support and slower growth in electric vehicle sales, heat pumps, and construction underscore the correlation between end-use efficiency investment and subsidies. However, public spending faces challenges due to inflation and higher interest rates. The key question will be whether the business case for electrifying transport, renovating buildings, and improving industrial efficiency becomes sufficiently compelling to attract significant private sector investment. Doubling annual energy intensity improvements by 2030 necessitates a threefold increase in investments. Energy efficiency is a cornerstone of keeping the 1.5°C temperature goal within reach, yet the world is falling short in terms of investment. To achieve the necessary transformation, governments, businesses, and investors must prioritize energy efficiency and end-use investments, leveraging innovative technologies and financial solutions. |

Eager to optimize your industrial processes and boost energy efficiency in the cement and glass sectors? Explore our two case studies: Cementirossi and Sisecam.

How energy transitions are changing investment decisions

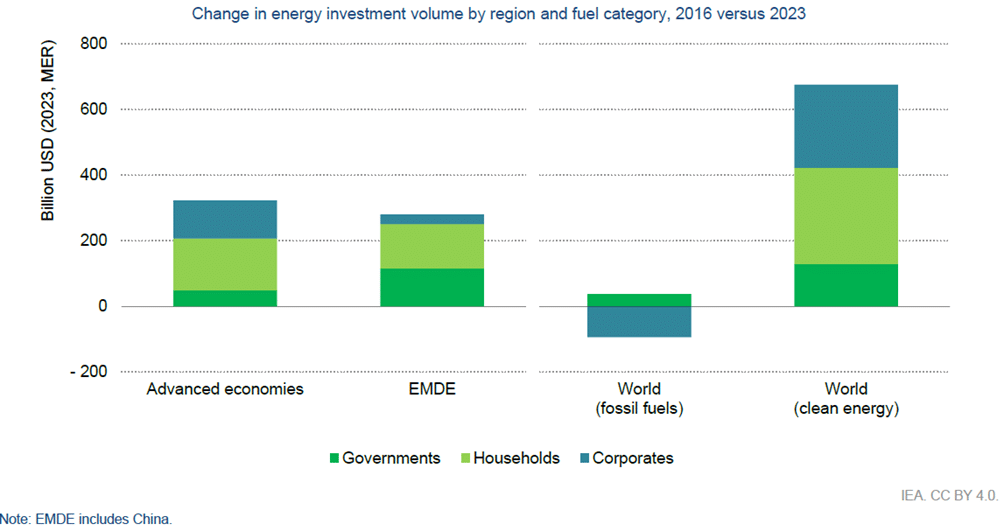

Energy transitions are reshaping how investment decisions are made and who makes them. While corporate firms still dominate energy investments globally, particularly in advanced economies, there are notable differences across regions. In EMDEs, half of all energy investments come from governments or state-owned enterprises (SOEs), compared to just 15% in advanced economies. National oil companies, especially in the Middle East and Asia, have significantly increased their investments in recent years, playing a key role in fossil fuel and energy sector funding.

Globally, around 75% of energy investments are now funded by private and commercial sources, while public finance accounts for about 25%. National and international development finance institutions (DFIs) contribute only 1%. Market sentiment toward sustainable finance has weakened, with environmental, social, and governance (ESG) funds seeing a decline in 2023 due to better returns elsewhere and concerns about their credibility. Transition finance is emerging to attract capital for high-emitting sectors, but stronger standards and greater harmonization are needed for it to grow on a larger scale.

Investment challenges in achieving global net zero by 2050

After a careful evaluation on the key findings, the IEA report has tracked the COP28 progress.

As the world aims to limit global warming to 1.5°C, current investment trends in clean energy and infrastructure fall significantly short of what’s required to meet this goal. According to the International Energy Agency (IEA), an additional USD 500 billion per year is needed to bridge the investment gap, particularly for renewable energy generation, grids, and battery storage. This increase would represent a doubling of current annual spending by 2030, with the aim of tripling global renewable energy capacity.

Achieving the goal of doubling the pace of energy efficiency improvements will demand an even greater push. Investments in building efficiency fell in 2023 and are projected to decrease further in 2024. To double the rate of efficiency progress, annual spending on efficiency and electrification needs to triple, reaching around USD 1.9 trillion by 2030.

The IEA’s Net Zero Emissions by 2050 (NZE) Scenario calls for a sharp reallocation of capital, with annual investments in fossil fuels such as oil, gas, and coal expected to drop by more than half by 2030. Meanwhile, low-emission fuels like bioenergy and hydrogen, along with carbon capture, utilization, and storage (CCUS) technologies, must see increased investment to meet net-zero targets.

A significant barrier to these investments, particularly in EMDE, is the high cost of capital. Development finance institutions (DFIs) have a key role to play in reducing these costs and mobilizing private capital. Between 2013 and 2021, DFIs provided USD 470 billion for energy projects, with more than 90% of this support taking the form of debt. The lack of local-currency financing drives up borrowing costs and is a major factor behind the high cost of capital in EMDEs. Addressing this issue will be crucial to accelerating investment in clean energy globally.

Implications for evolving financial frameworks: meeting investment needs under the NZE scenario

To meet the ambitious investment goals outlined in the NZE Scenario, a more evolved financial architecture is essential, tailored to the specific needs of transition activities and emerging markets. The current market conditions, characterized by rising interest rates and tighter regulations, have created a challenging environment for sustainable finance. Innovative risk-mitigation instruments and support mechanisms are crucial, especially in emerging markets. While the private sector plays a dominant role in advanced economies, growing domestic private financing in emerging markets is equally important to reduce currency risk and reliance on external sources.

To effectively direct finance towards energy investment in emerging markets and catalyze clean energy transitions, appropriate tools and systems must be implemented. This includes enhancing the credibility of carbon markets, addressing concerns related to over-crediting, lack of additionality, and potential human rights abuses.

Strengthening transition finance mechanisms and sustainable finance regulations, particularly in the context of high-emitting, hard-to-abate sectors, is also crucial to ensure that financing aligns with the diverse trajectories of emerging markets compared to advanced economies.

Conclusion

In light of the findings from the World Energy Investment report, it is evident that significant changes are necessary to meet global energy goals and combat climate change effectively. While investments in clean energy technologies are rising, there remains an urgent need to address disparities, particularly in emerging and developing economies. The transition towards renewable energy and enhanced energy efficiency must be prioritised to fulfil COP28 targets. By fostering collaboration between public and private sectors and mobilising sufficient funding, we can pave the way towards a sustainable and resilient energy future.

Want to learn more? Read the full report here.

Interested about how Exergy’s technology can support your business in achieving energy transition goals while advancing towards a cleaner, more sustainable future?

Explore our waste heat recovery solutions for the industrial sector, power stations, and geothermal power generation. For further information, feel free to contact us here.